capital gains tax news 2020

Say you are a. Long-term capital gains are usually subject to one of three tax rates.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

But will the tax increase this year.

. The IRS typically allows you to exclude up to. First deduct the Capital Gains tax-free allowance from your taxable gain. The government raked in a record 143bn in Capital Gains Tax CGT in the 202021 financial year up 42 on its take the previous year official statistics show.

Free shipping on qualified orders. 250000 of capital gains on real estate if youre single. Joe Bidens Tax Plans.

CAPITAL GAINS TAX may see a huge hike in a bid to raise more money following the expense of the coronavirus pandemic. They are taxed at rates of 0 15 or 20 depending on the investors taxable income but these rates. Rather than be subject to the normal individual income tax rate 37 percent for the highest bracket of earners carried interest so long as it is held for at least three years is.

Add this to your taxable. Your tax rate is 0 on long-term capital gains if youre a single. Read customer reviews best sellers.

Tax Changes and Key Amounts for the 2022 Tax Year. Here are important capital gains tax rules to keep in mind. Thats a potential increase of.

The UK Government made a record haul for Capital Gains Tax CGT in the 202021 tax year raising a total of 143bn from 1006bn 201920 on just 323000. Ad Get Access to Our In-Depth Global Research on Equities Fixed Income and the Economy. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate.

Assuming that youre single you would calculate capital gains taxes on this sale as follows. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Long-term capital gains taxes for 2020 tax year.

0 15 or 20. 500000 of capital gains on real estate if youre married and filing jointly. The changes affect the Capital Gains Tax CGT.

Ad Get the Ultimate In Financial News and Analysis With Bloomberg. Capital gains tax CGT receipts for tax year 202021 released by HM Revenue Customs HRMC have reached their highest ever level of 143bn. 40400 0 Percent 0 190000 - 40401 149599 149599 15 Percent.

Data news and analytics through innovative technology. When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to 434. Get Access to the Largest Online Library of Legal Forms for Any State.

Ad Browse discover thousands of unique brands. Also missing is a plan to increase taxes on investment earnings known as capital gains to 25 percent as well as an expansion of the net investment income tax more than half. On the other hand long-term capital gains get favorable tax treatment.

Free easy returns on millions of items. Top Stocks to Buy in 2022 Stock Market News Retirement. Market and Investing Insights from Our Investment Professionals to You.

Long-term capital gains taxes for 2020 tax year. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. As the tables below for the 2019 and 2020 tax years show your overall taxable income.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. The last few years have seen a number of changes to the UKs tax regime with the latest coming into force on April 6th 2020.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Long-term capital gains taxes are assessed if.

Capital Gains Tax Advice News Features Tips Kiplinger

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Capital Gains Tax Advice News Features Tips Kiplinger

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Long Term Capital Gain On Property Owner Critical Things To Know

How Much Tax Will I Pay If I Flip A House New Silver

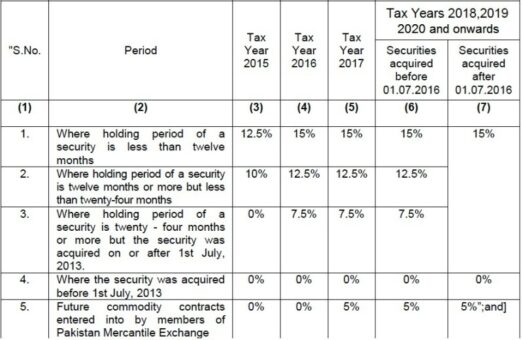

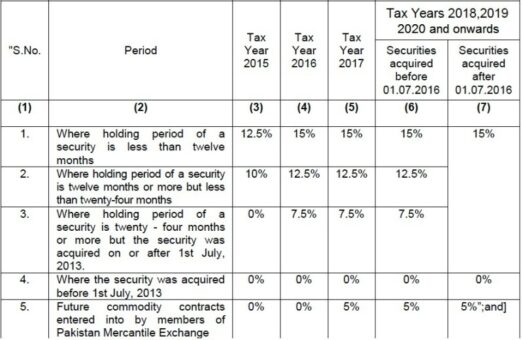

Rate Of Capital Gains Tax On Disposal Of Securities Pkrevenue Com

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Exemption From Capital Gain Tax Complete Guide

Reporting Of Capital Gain On Sale Of Equity Itr 2

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)